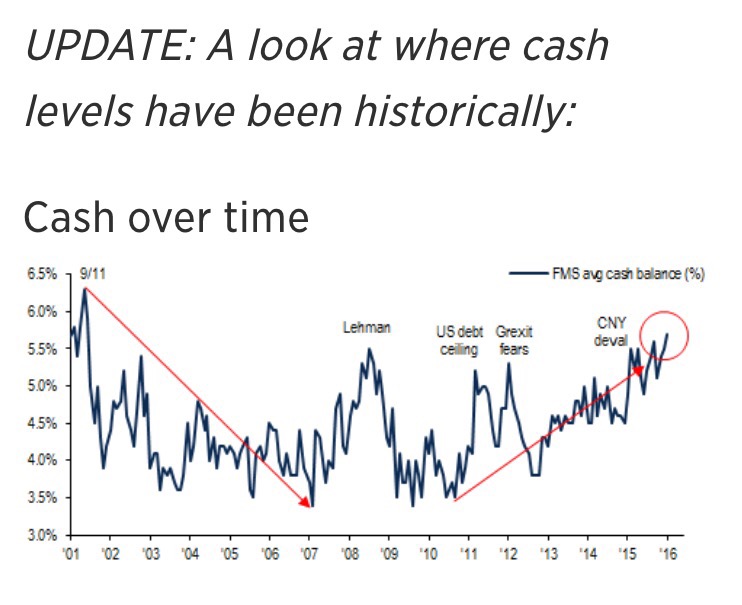

I found this chart to be kind of comical in the sense that it signifies almost nothing. Yet, it’s been cited by a big bank and it’s hit the CNBC newsfeed. Could a 2.5% swing in the level of current cash holdings in mutual funds mean all that much? Seems like an insignificant squiggly line to me.

Who’s Afraid of a Fiduciary Duty?

In this politically heated environment, yet another partisan battle ensues in Washington. It highlights a sad reality of how difficult it is to do what is so obviously right for consumers. In particular, the battle is over the concept that all investment advisors should adhere to a legal fiduciary duty to their clients when providing financial advice. Until very recently, this duty was largely followed by only a subset of financial professionals, registered investment advisors.

Viewed at a high-level, a fiduciary duty is simply the professional obligation to place the interests of the client first at all times and under all circumstances.

In many ways, the public’s ability to recognize a financial advisor acting as a fiduciary reminds me of that old legal definition of pornography – you know it when you see it. However, that doesn’t cut it when some in the financial services industry seem intent to blindfold the public. Amid a flurry of paperwork and small-print disclosures, most consumers are wholly ill-equipped and outgunned. That is precisely what industry regulation is designed to counter.

The quest to implore all financial advisors to operate under an obligation to act as fiduciaries has been the Holy Grail for as long as I can remember. Due to a massively powerful lobbying effort from those with a vested interest to avoid a legal obligation to first serve the interest of their customers, the foot-dragging among our regulators and politicians over the years was striking to watch. Finally, in April, the Obama administration took matters into its own hands.

Using the existing framework that imposes a fiduciary duty standard on financial advisors in their dealings with pension and employer-sponsored retirement plans, the Department of Labor simply expanded that same obligation to any professional who also provides advice to consumers who own an individual retirement account (IRA). In one fell swoop, that regulatory expansion brought almost every financial advisor into the fiduciary world. With a stroke of the executive branch’s pen, the last foot was dragged across the finish line.

Predictably and disappointingly, the House and the Senate – mostly along party lines -recently voted to strike down the new fiduciary duty rule. Obama’s veto last Wednesday successfully kept the rule in place.

In my view, despite the loss of a clear-cut competitive differentiator for me and my fellow registered investment advisors, the new fiduciary rule is a resounding victory for consumers. Let’s hope it survives our dysfunctional politics.

Understanding Your Investment Fees

At the Front Street Foundation’s recent Money Series workshop, an attendee asked a deceptively difficult question. She wanted to understand how to figure out the cost of her investment program. That’s a simple enough request, right?

It should be easy for consumers to safely navigate the investment industry. Never is this more the case than it is today. Just last month, essentially every professional who provides financial advice must now operate under the same fiduciary duty rules independent registered investment advisors have always lived under. It is a long overdue and good change for investors.

Given this, my initial suggestion was for her to ask her current advisor what she’s paying. After all, it is a quick calculation for a professional to make and, now, it is her advisor’s obligation to provide her this information. Sadly, she didn’t trust her advisor to give her the straight scoop. She clearly has a larger issue to address, other than knowing the cost of her investment program.

I’ve been asked about fees often in my career and have helped calculate the fees paid by investors on countless occasions. Here’s a basic primer on how you can do it from the comfort of your own home.

For the typical investor who invest in mutual funds, grab your most recent brokerage account statement and go visit morningstar.com.

Each mutual fund you own has a unique ticker symbol. Find the ticker symbol on your statement and just enter it in the search box at the top of the website. Click on the resulting mutual fund’s tab labeled, Expense, and scan down the page for the words, “Net Expense Ratio.”

The net expense ratio is the all-in cost of your mutual fund, presented on a percentage basis. Simply take this percentage and multiply it by the current value of your mutual fund holding. Repeat this process for each mutual fund you own and, finally, add up all the fees. Yes, some math is required.

However, there’s more. If you have also hired an adviser to manage your investments, you are probably paying advisory fees too. Further, if you’ve chosen to work with someone who sells financial products for a commission, some deeper digging is required.

No consumer would dream of buying groceries, clothes or a plane ticket without knowing the price. It begs the question, why do so many do just that when it comes to their investments?

Jason P. Tank, CFA will present, “Understanding Your Investment Fees” at the Front Street Foundation’s Money Series on June 15th at 6:30pm in the McGuire Room at the Traverse Area District Library. Call (231) 714-6459 or visit FrontStreetFoundation.org, if you plan to attend. Front Street Foundation is a local nonprofit providing financial education for all people.

Spring Cleanup For Your Money

It’s that time of year where you peer outside after a long winter and see an unwelcome amount of debris and disorder awaiting your spring cleaning efforts. The fortunate among us hire a cleanup crew. The planners among us pay attention to the friendly offer from the city to help haul it away for you. But, we’re clearly not all fortunate or planners.

While a nice looking yard is enjoyable, cleaning up your financial debris and disorder is far more important. Many people just never seem to get around to it. Let this serve as both a friendly reminder and an easy-to-follow starting guide.

As always, the most important step is the first one. Start by simply writing down your personal list of those nagging and long-neglected, money-related items in your life. But, be sure to keep it brief at first. People often craft an emotionally impossible list of things to accomplish. The result is entirely predictable; continued procrastination.

In the name of simplicity, craft your list into digestible bites that will allow you to move along the path to a simpler and more efficient financial setup. To begin, I will highlight three key areas you should focus on.

Start by taking a good look at your money mechanicals.

These are equivalent to digging out your dirty, outdoor furniture from winter storage or turning on your sprinkler system or taking your lawnmower in for that overdue tune up. If you ignore your mechanicals for too long, it gets awfully difficult to actually enjoy those summer moments. The same thing happens in your financial life.

I suggest an initial focus on three tasks and then move deeper from there.

Start by reviewing the inventory of your investment and financial accounts and taking special note of your current beneficiary designations for your retirement accounts and your life insurance policies.

Next, dig out your old, dusty, estate planning documents and make sure your former self’s thoughts are still valid and that nothing is worthy of a formal reevaluation.

Finally, have that short and important conversation with your spouse or loved ones about how they could actually access all of your accounts in the event you were no longer around. Write it all down on a single sheet of paper and keep it in a secure place. This simple step will absolutely save a lot of pain and inconvenience at a difficult time.

Together, these simple first steps will likely open up a world of profound thoughts regarding your financial affairs. Don’t let that scare you.

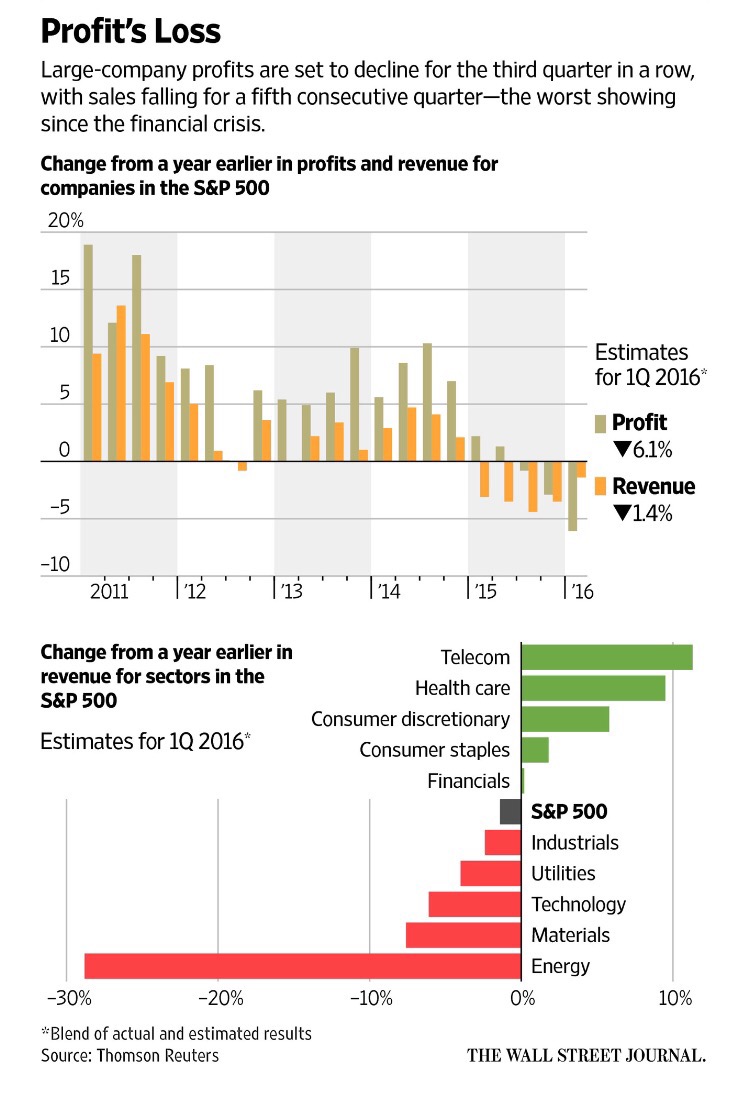

Slowing Earnings Growth

Here’s a picture of the slowing growth phenomenon that’s now turned into a three or four quarter negative trend.

Yes, the energy sector is a big part of the profit and revenue drag, but the earnings flatline has been far broader than just a single sector of the economy. This has certainly impacted Fed policy and has created a pause in investor optimism.

With the recent GDP print of 0.5% in the first quarter of 2016, on the back of only 1.4% annual growth at the end of 2015, a bit of investor anxiety is warranted. This is especially the case after a roughly 15% rebound in stock prices over the past two months.