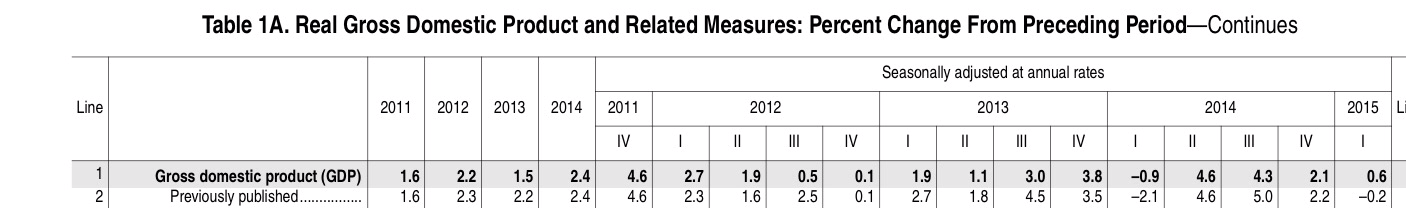

The recently released GDP report came out today, along with the revisions to their previous calculations stretching back over the past four years. I always find these revisions interesting, in the sense that it highlights the futility of reading too deeply into the markets’ reaction to current-day, real-time economic releases.

Overall, the stretch of 2011, 2012, 2013 and 2014 showed an even slower economic recovery than previously estimated. And, it wasn’t fast to begin with.

Overall, it’s safe to say the we’ve seen about 2% growth per year over this entire recovery since the summer of 2009. And, we’ve even seen two years of sub-2% growth, in 2011 and 2013.

It’s quite amazing the companies have done as well as they have, unless one looks at anemic wage growth and the tepid business investments made over this period. Those moves, coupled with large share buybacks, has upheld earnings per share growth that investors like to see.

These decisions do have longer term ramifications on economic growth, however. I think we’re seeing these ramifications in the picture above.

For 2015, so far, we’ve now seen a 0.6% first quarter and a 2.3% second quarter. Together, the first half has shown growth of about 1.5%. If the second half accelerates – as most expect – for whatever reason – another 2% full year is in the cards.

This is certainly an odd recovery, to say the least – especially in the face of such low rates and robust stock market performance (especially 2013). Disconnect is a reasonable adjective to use.